How Obamacare WORSENS Poverty

There are many arguments to be marshaled about the ill effects of Obamacare – but a little-seen analysis issued several weeks ago offers a devastating indictment about how the law will effectively hurt the very people it is designed to help. In testimony before a Ways and Means subcommittee hearing, the Urban Institute’s Gene Steuerle discussed the “poverty trap” developed by means-tested government programs – a trap that Obamacare will both extend and worsen.

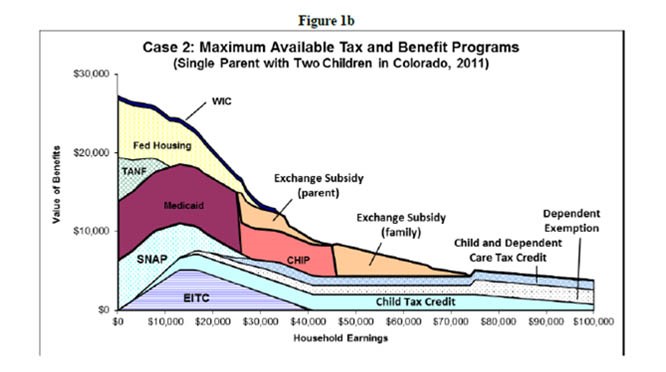

The “poverty trap” is best demonstrated graphically, as Steuerle’s testimony illustrates. The chart below shows a hypothetical example whereby a family (single parent and two children) can receive nearly $30,000 in government benefits with no household earnings, but only about $10,000 in government benefits with $35,000 in household earnings:

Another chart shows a similar example from a slightly different graphical perspective. The chart (Figure 4) shows the effects of rising income on a single parent with two children in Alabama whose income rises from the federal poverty level to twice poverty. Under that situation, if the family’s income rises by about $17,000, the family will LOSE over $10,000 in government benefits. As a result, “income would rise by only about $6,900—an effective average marginal tax rate of about 60 percent, to which must be added any loss of health insurance benefits.” These examples, and so many more like them, often lead families to ask the obvious question: If I will lose so many government benefits by generating additional income, why work?

And in the main, Obamacare WORSENS this problem, rather than improving it. By extending insurance subsidies up the income scale, it does eliminate the Medicaid “cliff,” whereby individuals may stop working now in order to remain eligible for Medicaid benefits (because Medicaid eligibility isn’t determined on a sliding-scale basis – you’re either eligible for it, or you’re not). But extending the subsidies up to four times poverty only EXTENDS this “poverty trap” further up the income ladder to middle-income individuals – who now will face the same “cliff” that some Medicaid beneficiaries currently face. Families will forego making $1,000 of additional income if it will cost their household $5,000 or more in insurance subsidies – as it will for families who barely exceed the 400% cut-off for subsidy eligibility. No wonder the Congressional Budget Office said that the law’s “phaseout of the [health insurance subsidies] as income rises will effectively increase marginal tax rates, which will also discourage work.”

Ronald Reagan famously said that the nine most terrifying words in the English language are “I’m from the government and I’m here to help.” By penalizing success and discouraging work, Obamacare is the quintessential example of that truism. Because, by trapping people in a cycle of poverty and dependence on government assistance, Obamacare doesn’t enhance true security for millions of low-income Americans – it UNDERMINES it.